nassau county tax grievance status

Between January 3 2022 and March 1 2022 you may appeal online. Are You Confused About Your Property Taxes.

Nassau County Property Tax Reduction Tax Grievance Long Island

Tax Assessment Review Forms.

. The County Will Review Your Grievance and Make an Offer. Your assessment cannot be increased. Form AR 15 To Request a Receipt for Your Application.

Nassau county property tax grievance information nassau county filing deadline extended to april 30 previous deadline for filing. You must file your appeal between january 2 2015 and 1159 pm on march 2 2015 if you want the. Nassau County Property Tax Grievance Filing Deadline Extended to May 2 2022 - Maidenbaum Property Tax Reduction Group LLC.

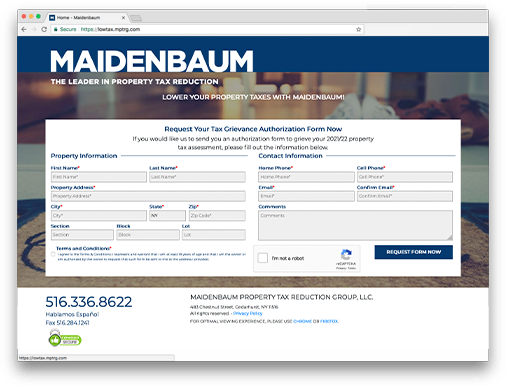

Request Your Tax Grievance Form Today. PROPERTY TAX GRIEVANCE AUTHORIZATION. You may file an online appeal for any type of property including commercial property and any type of claim.

631 302-1940 Nassau County. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair assessment of their homes for 30 years. Request Your Tax Grievance Form Today.

How to Challenge Your Assessment. Petition to Lower Property Taxes. Nassau county property tax grievance deadline is march 31 2022.

For tax year 20222023 the class one Level of Assessment is unchanged at 10 0010. At the request of Nassau County Executive Bruce A. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing.

Under NYS law filing a Property Tax Grievance cannot raise your Property Taxes Any homeowners in Nassau County that misses the Property Tax Grievance deadline of March 1st. 333 Route 25A Suite 120 Rocky Point NY 11778 Suffolk County. Are You Confused About Your Property Taxes.

Assessment Challenge Forms Instructions. Terms You Should Know. How long does it take to grieve taxes in Nassau County.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing. FOR THE 20232024 Nassau COUNTY FILING. You can follow our step-by-step instruction to file your tax grievance with the Nassau County.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Your assessment will be reduced or it will remain the same. This website will show you how to file a property tax grievance for you home for FREE.

There are only two possible results of filing a Nassau County Long Island tax grievance. During and after the presentation you will have the opportunity to use the Microsoft Teams QA feature to send in questions which will be addressed at the end of the workshop. On Monday February 7 2022 the Nassau County.

For tax year 20212022 the class one Level of Assessment was 10 0010. AR1 AR2 AR3 Forms and Instructions. Once a grievance is filed you are all set for that filing year.

At the request of Nassau County Executive Bruce A. 516 342-4849 email protected. The time to appeal a new assessment ends.

The Countys Assessment Review Commission ARC will be reviewing a record number of grievances reportedly more than. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. The complete tax grievance process usually takes from 9 to 24 months.

Toms Point Port Washington Outdoor Beach

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Nc Property Tax Grievance E File Tutorial Youtube

New To The Market In Rockville Centre Carol Gardens Co Op Rockville Centre House Styles Rockville

News Flash Nassau County Ny Civicengage

Opening Sales Doors Sell More Staffing Doors When One Door Closes Closed Doors

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Cullen And Dykman Llp

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau Residents Protest New York American Water S Tax Grievance Island Long Island Nassau

5 Myths Of The Nassau County Property Tax Grievance Process

Pin On Daniel Gale Sotheby S Awards

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island